He expects these companies to become “famous like Mobileye” with a market value of billions of dollars on Nasdaq. Karasso notes that several Israeli companies are considered world leaders in the field of sensors. This will require a more complicated system of sensors compared to the number of sensors currently in vehicles. Karasso claims the new vehicles that will go on the market in the coming years will include new features such as semi-autonomous integration on the freeway. These numbers are expected to boost significantly the purchase of such vehicles. The vehicles that have come out in recent years are equipped with ADAS systems that have reduced the number of road accidents by 40%, he explains. He believes that the global automotive industry along with a number of Israeli technology companies is to experience a significant breakthrough in the next two to three years. Shinhar further explained the growing number of automakers in Israel, saying Israel is the “only country in the world” that a space of 30 square kilometers hosts hundreds of technology firms, which can serve the needs of automakers.Īccording to Liav Ben Rubi, CEO of Quantum Hub, a Herzliya-based center aimed at promoting mobility and automotive startups, this industry in Israel is helped by technologies developed for the use of the IDF.Īmi Karasso is the manager of OnePR, a media consultant agency specializing in the auto industry.

“ Israel sells technology, and that is precisely what the industry needs now,” he asserted. On the other hand, innovation and out-of-the-box thinking are definitively Israeli trademarks. He tells Al-Monitor that an automotive industry requires heavy infrastructure and a relatively low-cost workforce - two components that were never Israel’s strong suit. Yohay Shinhar is a prominent Israeli automotive expert and consultant for top Israeli car importers. Still, even without a local automotive industry, it seems to have become a leader in autotech. Historians tell of Israeli attempts in the 1930s and 1940s to develop an Israeli vehicle named Carmel, but these attempts failed miserably. The first to do so was General Motors, which in 2008 opened a local R&D subsidiary in Israel. Presently, there are over 20 automotive makers, which operate local innovation and R&D centers in Israel, among them Volkswagen, Skoda, Seat, Ford, Mercedes and Renault-Nissan. The ingenuity of the Israeli autotech industry caught the attention of international corporations. Investments were divided as following: almost 25% for Israeli automotive startups active in the digitalization field, 21% for startups specialized in autonomous driving, 13% for new mobility startups, 12% were invested in electrification startups and the reminder in other auto-related fields. The report states that investment in startups in 2020 amounted to approximately US$1 billion. Ī report issued by Ecomotion last year said that since 2016, mobility startups in Israel have grown by 50%, growing from 400 companies to over 600 in 2020. This industry includes four major subsectors: new mobility (ride sharing or micro-mobility solutions), autonomous driving, digitalization (vehicles connected to the internet) and electrification. Its acquisition by Intel in 2017 for about US$15 billion is still the largest exit in the history of the Israeli high-tech industry.Īnother Israeli autotech project that grabbed international headlines - Better Place - for developing battery charging and battery switching services for electric cars ended in bankruptcy in 2013 but helped to establish the local automotive industry. The most successful story of the Israeli autotech industry is Mobileye, which develops autonomous driving technologies and ADAS. These two deals are another reminder of the status Israel plays in the global industry of automotive and new mobility.

On June 27, Israeli Artificial intelligence (AI) chipmaker Hailo announced its collaboration with semiconductor supplier Renesas to deliver a processing solution, which they say will allow advanced driver-assistance (ADAS) functions and automated driving (AD) systems.

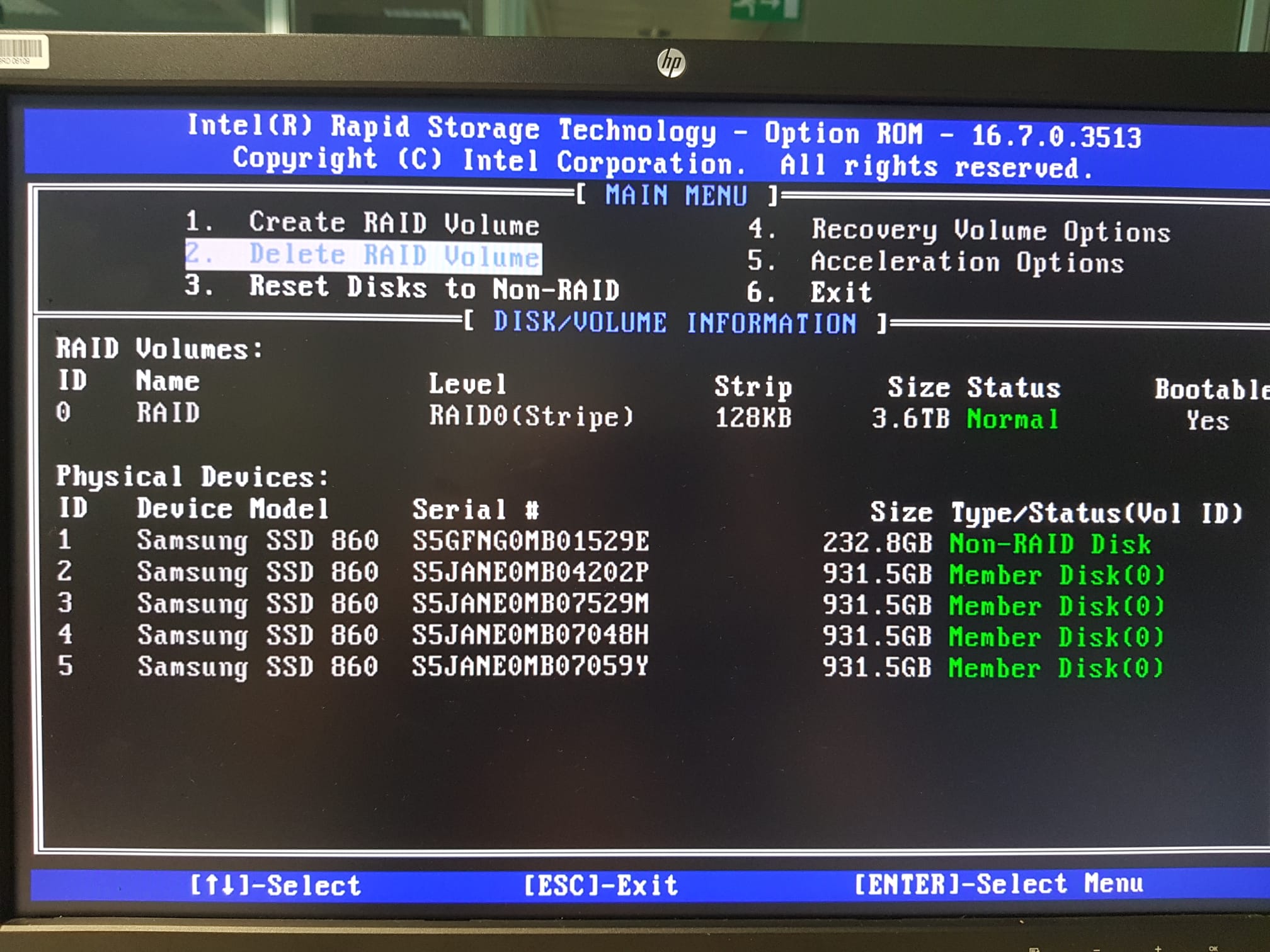

#Intel raid monitor software software

Innoviz chief executive and co-founder Omer Keilaf issued a statement saying, “We are thrilled to work with the (Volkswagen technology group) CARIAD team and be a supplier of LiDAR sensors and perception software to support safe mobility for vehicles launching from the middle of the decade.” 7 that the Volkswagen group will purchase autonomous driving software and hardware from the company, in a $4 billion deal. Israel’s Innoviz Technologies announced Aug.

0 kommentar(er)

0 kommentar(er)